capital gains tax indonesia

In general a corporate income tax rate of 25 percent applies in Indonesia. The settlement and reporting of the tax due is done on self-assessed basis.

A Tax Dilemma How Capital Gains Can Hold Financial Advisors Hostage Nasdaq

The choice is influenced by both commercial and tax considerations.

. Or - are present in Indonesia during a tax year and intending to reside in Indonesia. Sale of land andor buildings located in Indonesia. The rental income of nonresidents is taxed at a final withholding rate of 20 of gross income.

01 final tax on the proceeds of a share sale for companies traded in the Indonesia Stock Exchange. Individual resident taxpayers are individuals who. Last reviewed - 30 December 2021.

Capital gains derived by an individual are taxed as ordinary income at the normal rates. If the seller is non-Indonesian tax resident a 5 capital gains tax final due on the gross transfer value which has to be. For the transfer of unlisted shares 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller.

Taxable income - Taxable income of individuals includes profits from a business employment income and capital gains. 2 days agoThe capital gains tax brackets are. 0 for single and under 40400 and 80800 for married.

Residency tests are applied as follows. Gains on shares listed in Indonesia are taxed at 01 final tax of the transaction value. The sale of shares listed on the Indonesian stock exchange is subject to a final tax at 01 percent of gross proceeds.

In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. Taxation in Indonesia is determined on the basis of residency. A 01 final withholding tax is imposed on proceeds of sales of publicly listed shares through the Indonesian Stock Exchange.

Gains on the disposal of land andor. Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. Immovable property referred to in Article 6 Article 13 1 3.

5 of the final tax based on the capital gains tax Indonesia proceeds or taxable sale value whichever is higher. The liable party is the entity that benefits financially from the gain. Corporate Tax Laws and Regulations covering issues in Indonesia of Tax Treaties and Residence Transaction Taxes Cross-border Payments Capital Gains.

Statement on Russia Associations Videos Search. Double-taxation agreements between Indonesia and other countries may reduce this to 10. An additional tax of 05 applies to the share value of founder shares at the time of an initial public offering.

Operated in international traffic movable property pertaining to such operations 13 3 5. Or - stay in Indonesia for more than 183 days in any 12-month period. Indonesian taxation is based on Article 23A of UUD 1945 1945 Indonesian Constitution where tax is an enforceable contribution exposed on all Indonesian citizens foreign nationals and residents who have resided for 183 cumulative days within a twelve-month period or are present for at least one day with intent to remainGenerally if one is present less than.

However gains from the transfer of land and buildings are not subject to regular CIT but rather are subject to final income tax at a rate of 25 of the transaction value or the government-determined value whichever is higher. Indonesia plans to charge value-added tax VAT on crypto asset transactions and an income tax on capital gains from such investments at 01 each starting from May 1 a tax official said on. The same tax rate exists for corporations and individuals for capital gains.

Individual - Taxes on personal income. The property is directly and jointly owned by husband and wife. An additional tax at the rate of 05 of the share value is levied on sales of founder shares associated with public.

15 for up to 445850 single and 501600. Nonresidents are taxed at a flat rate of 20. Companies listed on the Indonesia Stock Exchange IDX that offer at least 40 percent of their total share capital to the public obtain a 5 percent tax cut hence a tax rate of 20 percent applies for these public companies.

The tax is 5 final tax or 25 from 8 September 2016 on the taxable. The withholding tax rate on the transactions include. A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs.

Purchasing of oil fuel by parties other than state-owned. Acquisitions in Indonesia often take the form of a purchase of the shares of a company as opposed to a trade and asset acquisition. Capital gains - Capital gains derived by an individual are taxed as income at the normal rates.

The normal rate of corporate income tax is 25. Corporate Tax Report 2022 Indonesia. However the new Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax.

Assets arising from Tax Amnesty program Indonesia has rolled out Tax Amnesty program from 1 July 2016 to 31 March 2017 and any newly declared assets under this program cannot be depreciated or amortised for tax purposes. Movable property forming part of Business property of a PE Fixed Base 13 2 4Ships Aircrafts Boats etc. Tax treaties Tax treaties and related documents between the UK and Indonesia.

The tax rate is 20 for limited liability companies where at least 40 of their shares are traded on the Indonesian stock exchange. - are domiciled in Indonesia. 6 April 1995 for Income Tax and Capital Gains Tax.

Shares of Real Estate company 13 4. An additional tax of 05 applies to. The acquisition costs of these assets are based on the value declared in the Tax Amnesty Declaration Letter.

20 final tax on interest income earned from local and Indonesian-based banks regardless of the currency. The property was worth US250000 or 250000 at purchase. Basket Get Email Updates.

025 or 030 based on the selling price. However there are several exemptions. Gains on shares listed in Indonesia are taxed at 01 final tax of the transaction value.

Capital gains taxes. Taxation on Capital Gains and Investment Income Capital gains are generally assessable at standard income tax rates together with other income of the individual. Purchasing of oil fuel by state-owned gas stations or private gas stations.

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Income Tax Filing Taxes Capital Gains Tax

Top 8 Things To Know About Taxes For Expats In Indonesia

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

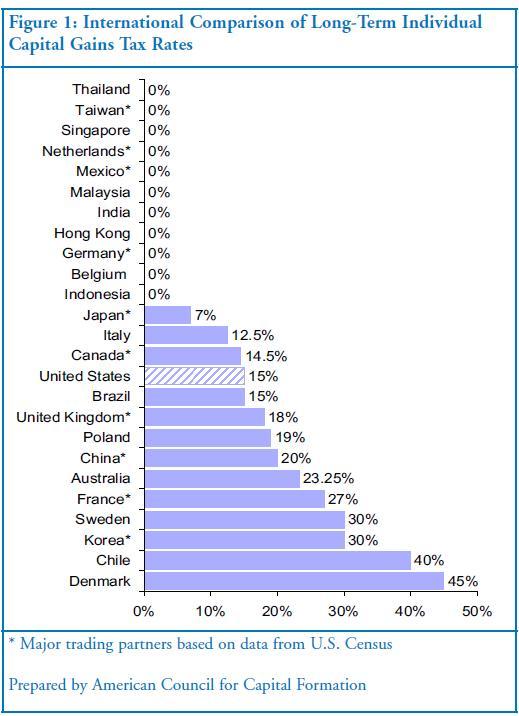

Capital Gains Tax Would Buffett Prefer To Live In Holland

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

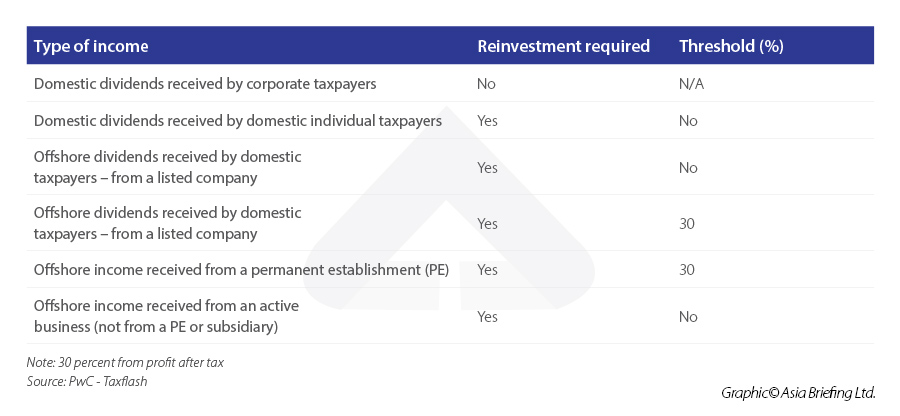

Taxation Of Investment Income Within A Corporation Manulife Investment Management

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Conceptual Framework Of Income Taxes Gdp Source Author H02 Download Scientific Diagram

Conceptual Framework Of Income Taxes Gdp Source Author H02 Download Scientific Diagram

Tax Identification Numbers In Laos Compliance By June 2021

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

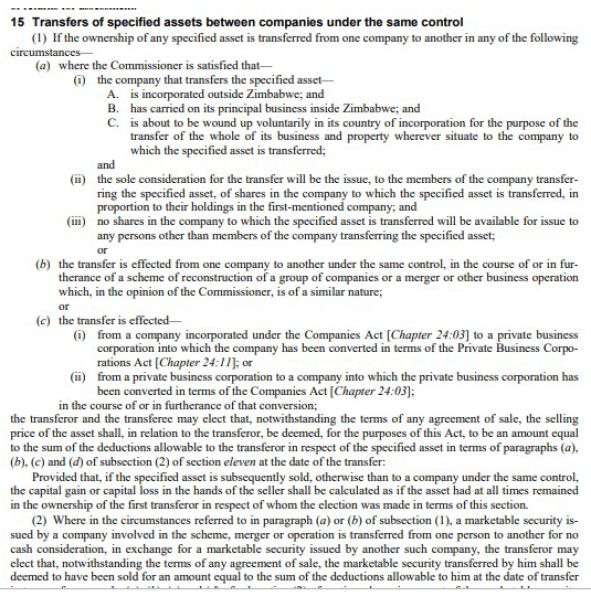

Capital Gains Tax Capital Gains Tax Zimbabwe

Capital Gains And Why They Matter A Tax Expert Explains

Forex Trading Academy Best Educational Provider Axiory Global

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq