does massachusetts have an estate or inheritance tax

The estate tax is a tax paid by the estate of a deceased person if. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax.

Estate Inheritance And Gift Taxes In Connecticut And Other States

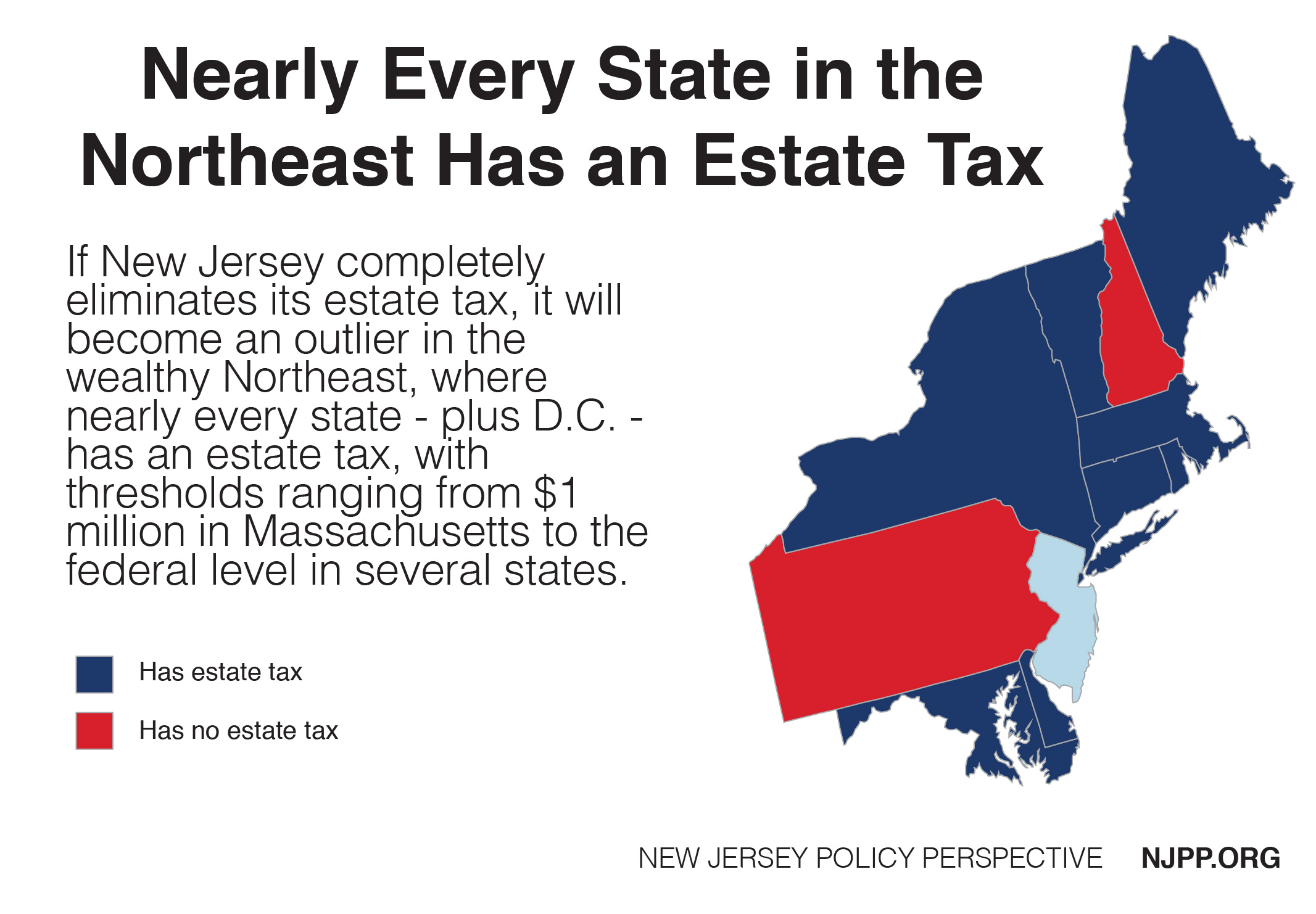

A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both.

. Fortunately Massachusetts does not levy an inheritance tax. If the estate is worth less than 1000000 you dont need to file a return or. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both.

If it is valued at one dollar over 1M your estate. The terms inheritance tax and estate tax are often used interchangeably but they are very different things. For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000.

Well in short that means that if you die during 2006 or any time thereafter you do not need to file a Massachusetts estate tax return if you have less than 1000000 in assets. Which states have a state inheritance tax. The Massachusetts estate tax would be about 900000 if you were a resident of the Commonwealth at your death.

Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut has the highest exemption level at 91 million. Tax Structure Massachusetts residents face a multitude of taxes. Of the six states with inheritance.

Massachusetts and Oregon have. The Massachusetts estate tax exemption is 1M. When you die if your estate is valued at 1M or under you pay no estate tax.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. Fortunately Massachusetts does not levy an inheritance tax. Here are a few of them.

Some states will levy an inheritance tax regardless of where the beneficiary or heir lives.

Estate And Inheritance Tax Bogleheads

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

State Death Tax Hikes Loom Where Not To Die In 2021

State Estate And Inheritance Taxes Itep

A Guide To Estate Taxes Mass Gov

Massachusetts Inheritance Laws What You Should Know Smartasset

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Massachusetts Estate Taxes Massachusetts Estate Planners Toolkit Mcnamara Yates P C

What Is An Estate Tax Napkin Finance

Does Your State Have An Estate Or Inheritance Tax

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Does Massachusetts Track Gifts For Estate Tax Return

Estate Tax In Massachusetts Slnlaw

Massachusetts Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Massachusetts Inheritance Laws What Will Happen To Your Estate If You Die Without A Will Don T Tax Yourself